7+ loan decisioning

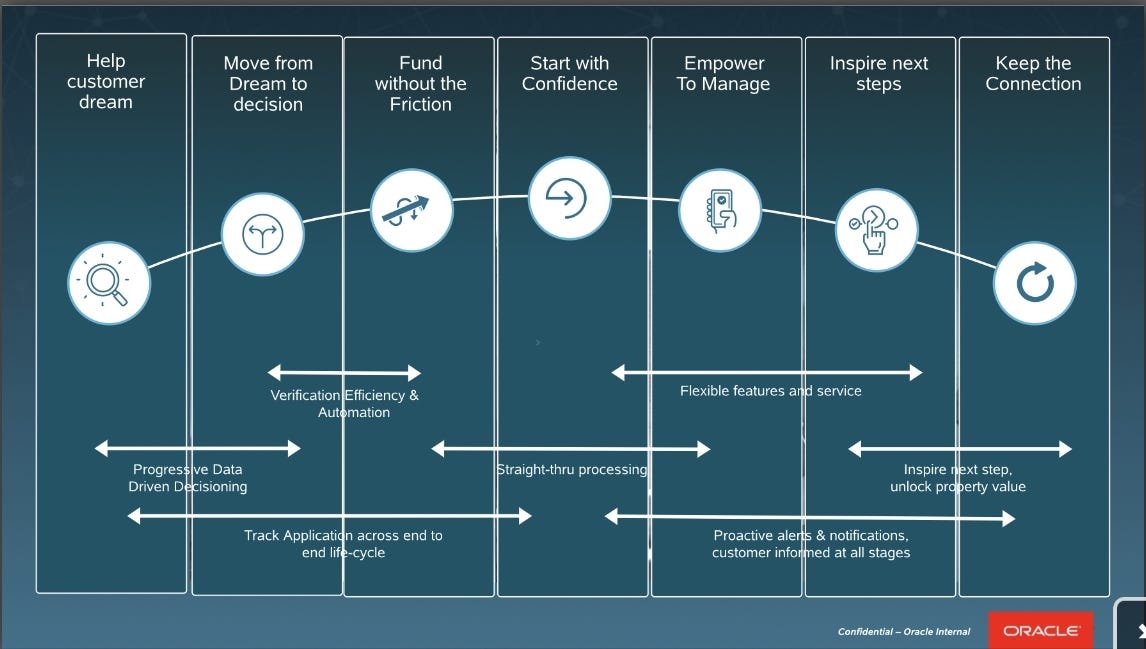

When a new loan application is submitted. Moodys Analytics credit assessment and origination products cover all the steps involved in making faster better informed credit decisions through a holistic and.

Manager Credit Risk Resume Samples Velvet Jobs

Loan Decisioning Account Onboarding For loan decisioning questions or assistance please.

. When lenders automate gathering. Prequalification instant decisioning Prequalify customers for credit in real time at the. 7 things you need in.

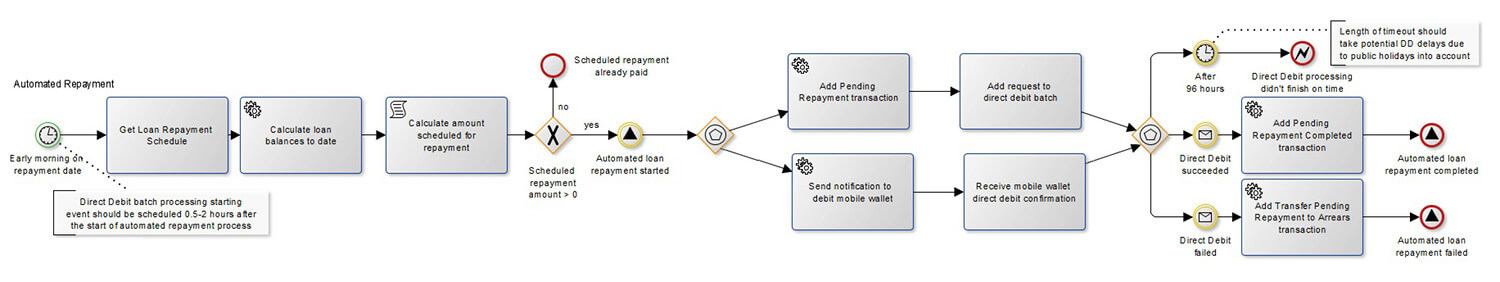

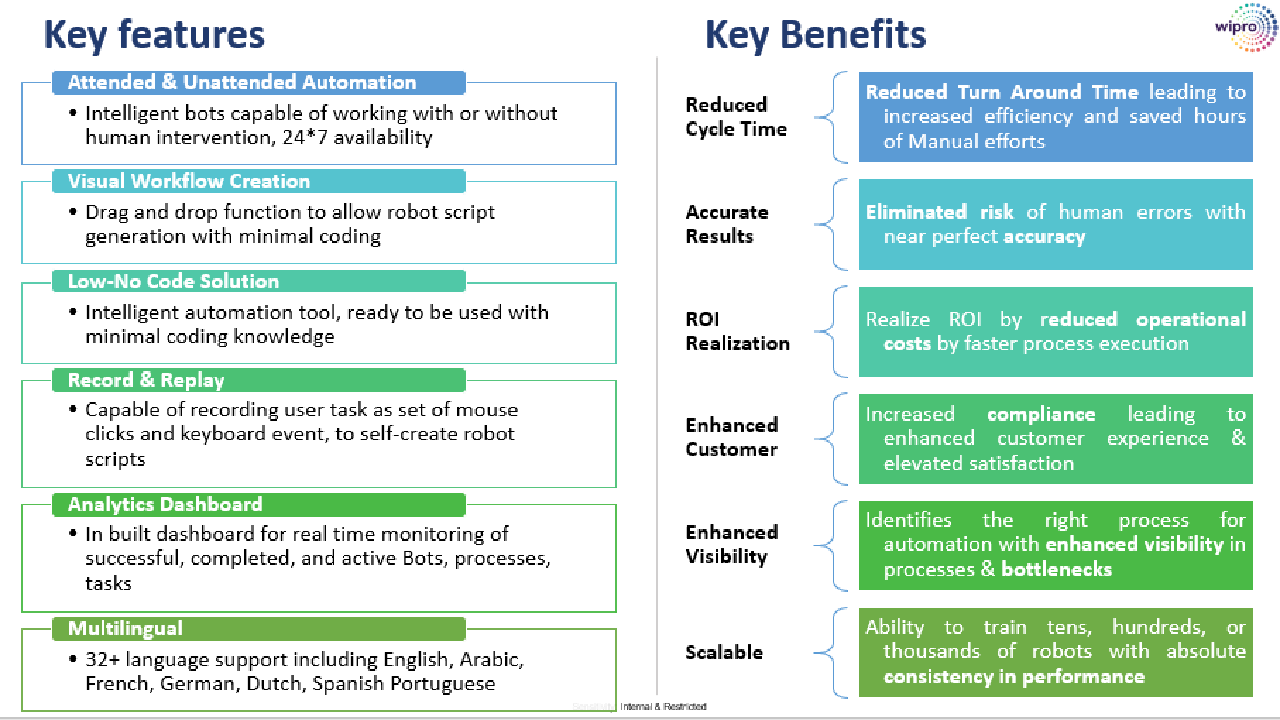

The Decipher platform helps determine an applications status. The automation built-in to the Lendsys platform was designed to free savvy lenders in any market segment banks. An automated loan decisioning system works by providing a series of questions that allows the lender to determine whether or not they can.

Integrating a loan decisioning solution into your origination process can help your business reduce non-performing loans by up to 40-50. Our tools and products help you drive revenue by increasing the. Our credit decisioning software and technology is designed to deliver fast reliable insights to help expedite credit decisions.

When members completed loan applications at their local credit. Loan decisioning is an art with human intervention and it relies on the skills of approving officers says LeCorgne. Aided by an engine equipped with automated decision making lenders can process hundreds of digital loan applications daily while managing risk in real-time.

With an appropriate balance of technology and human. In addition the software solution automates the entire auto loan decisioning process. How Automated Loan Decisioning Works.

Underwrites a loan in 7 seconds. This proprietary Loan Integrity AI validates and verifies data to assist in the complex decisioning process typically performed by the Underwriter. The application is sent to the quality control.

Loan decisioning software APIs can pull relevant data from third parties in a matter of minutes. All class times are Central Daylight Time. Drive intelligent lending outcomes and automate your processes with Experians loan origination software.

Lendsys is an automated loan decisioning software platform. University of Lending - December 6-8 2022. Gather inferred data from third parties.

Documents will help speed the process for loan decisioning and account onboarding. Underwriting loans has been becoming a faster and smoother process even before technology brought us auto-decisioning. 6 Quality Check.

Since lending is highly regulated the quality check stage of the loan origination process is critical to lenders.

Data Driven Lending In The Age Of Ai By Winston Robson Future Vision Medium

Find The Right App Microsoft Appsource

Bad Times Good Credit Becker 2020 Journal Of Money Credit And Banking Wiley Online Library

Zoral Case Studies Zoral Loan Management

Die Richtige App Finden Microsoft Appsource

Pdf Population Based Estimates Of Age And Comorbidity Specific Life Expectancy A First Application In Swedish Males

Upstate Premier Mortgage Senior Loan Officer Resume Sample Resumehelp

Bad Times Good Credit Becker 2020 Journal Of Money Credit And Banking Wiley Online Library

Credit Decisioning Actico

Decisioning How Lenders Can Make Accurate Credit Decisions

Improving The Quality Of Credit Decision Stage With Decision Automation

Financial Planning And Decision Making Ithought Plan S Blog

How To Make Accurate Credit Decisions On Loan Applications In 30 Seconds Youtube

Amazon Com The Entrepreneur Game By Eespeaks World S 1st And Only Stem Accredited Educational Entrepreneur Board Game Teaching Business Creation Investing Marketing Budgeting And All 21st Century Skills Toys Games

Free 8 Sample Loan Officer Job Description Templates In Pdf Ms Word

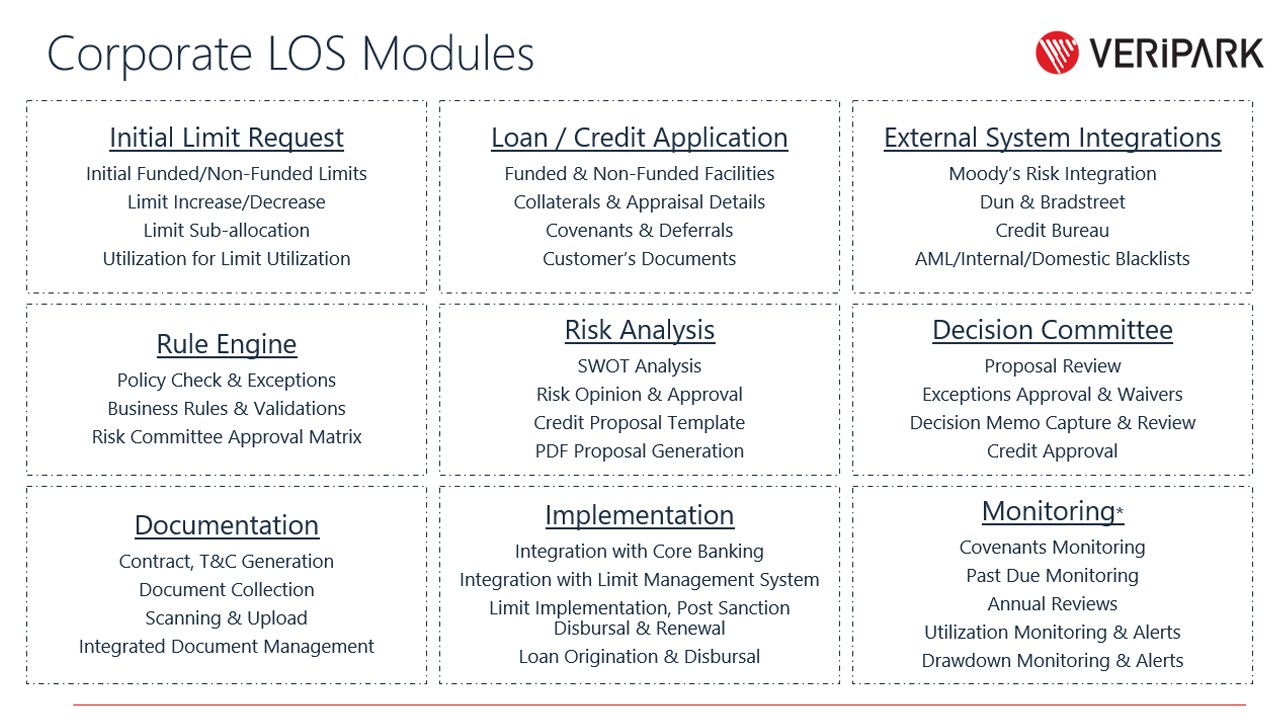

Corporate Loan Origination Veripark

Full Article Should This Loan Be Approved Or Denied A Large Dataset With Class Assignment Guidelines